I know , I know. I said I wasn't going to tweak the weekly update charts any more, but after last week's MAMA and MACD studies I decided that this version reflects the impending momentum and reversal probabilities better.

I've deleted the VIX comparison overlay for now. There's no imminent signs of a near term cross and removing it allows me to pile on the MAMA study using a 3, 7 and 14 EMA.

I've also deleted the MLR6 study as few platforms allow you to create such an indicator without considerable programming, but I'm looking at alternate ways to display it without cluttering the larger price chart

I'm keeping the LR30 study overlay as I'll be publishing some studies on that down the line and I'll warn you ahead of time that it's a great tell.

The middle panel MACD periods have been revised to 4,16,5 per the MACD signal line study and I've added a 3,7 EMA of the MACD (not the price) to clarify signal crosses.

The lower panel has RSI(2) and Stochastics 10,2,2 indicators laid over the volume bars.

As feared last week, prices in 3 of my little ETF basket have effectively kissed the LR30 lower channel band goodbye this past week, and although all 4 ETFs are displaying some form of a doji or spinning top (normally suggesting the possibility of at least a short term reversal) a quick look back on the charts as to what happened the last few times this candle pattern set up should temper your enthusiasm for a rally.

The midpanel technicals suggest the Qs and XLE as the most likely candidates if a short term rally does materialize as they have formed little basing patterns while the IWM and XLF continue downslope.

Although I've been nibbling at GE, MSFT, and the Qs (hedged, of course) going into March expiration, I need a lot more positive technical signals before getting too enthusiastic about this market.

Finally, for anybody that's interested in becoming a prop trader,

Bright Trading is having a number of get-to-know-us sessions around the country in the next 2 months. These guys are the real deal, having been at it for 30 years and I almost went to work for them 5 years ago, but decided Vegas wasn't my thing (you can traded remotely with them). A few hurdles to jump over (you need to get a series 7), but they know how to make money with really controlled risk. A tough act to follow (IMHO). I'm not a promoter for Bright and receive nothing for directing traffic that way . . . I just think this is a great free opportunity to kind of look under the sheets and see if this kind of trading appeals to you if you're around one of their session sites.

Despite yesterday's distinctly negative performance, there were a few intraday trading setups using the VIX that yielded a few dimes and a quarter into the close.

Despite yesterday's distinctly negative performance, there were a few intraday trading setups using the VIX that yielded a few dimes and a quarter into the close.

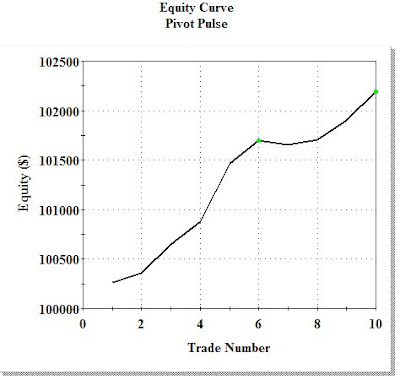

Above is a portion of my Excel workheet of weekly Qs pivot stats that drives the charts.

Above is a portion of my Excel workheet of weekly Qs pivot stats that drives the charts.