This post continues Monday's theme, but is based on a different concept.

This post continues Monday's theme, but is based on a different concept.Today's system capitalizes on a tendency of the IWM to surge after expiration Friday and the goal is to capture a short term gain without exposing the account to excessive risk.

The chart uses the TS "paint" function to display expiration days as white vertical oblong bars and the blue line is the 6 DSMA.

Two variations of the system are profiled.

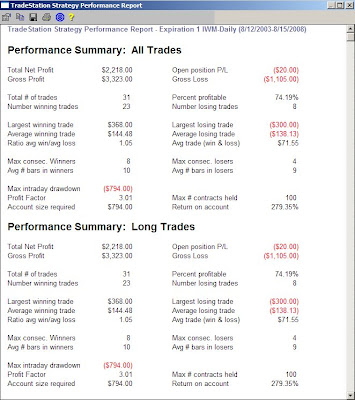

The first system enters long the day before expiration if the close on that day is greater than the 6 DSMA. The system exits 10 days later. There is a stop loss and a breakeven floor stop . . .both set at $300 per 100 shares of the position. A percent stop is probably the more effcicient way to format the stop as the trade log extends for 5 years and the since IWM was in the 30's in 2003, the returns are a bit skewed. Somthing for you to work on.

The second system is ditto the first, but without the conditional MA filter. Same stops. . same fixed exit.

The MA filter cuts the number of total trades in half, as well as the total return. With current stops in place, the only significant risk gain by utilizing the MA filter is a reduction in max intraday drawdown. The MA filter system has (surprisingly) fewer consecutive losers, a nice feature that balances the marginal loss of overall system efficiency. Worth a closer look for you code tweakers.

The MA filter cuts the number of total trades in half, as well as the total return. With current stops in place, the only significant risk gain by utilizing the MA filter is a reduction in max intraday drawdown. The MA filter system has (surprisingly) fewer consecutive losers, a nice feature that balances the marginal loss of overall system efficiency. Worth a closer look for you code tweakers.

Again, I use these systems to gauge short term market momentum as I daytrade 5 and 10 minute bars, although I will occasionally put on a longer term 5-10 day trade to capture clearly trending markets.

TS 2000i is shown below. From now on I'll be putting code at the end of the post. Some issues with blogger create some weird problems when you use the <> in the middle of a post and then try to narrate on. In some posts, it's taken me up to an hour to fix the problem and I inevitably lose whole sections of the narrartive that I have to recreate. To avoid that frustration in the future, code will be at the end.

TS 2000i is shown below. From now on I'll be putting code at the end of the post. Some issues with blogger create some weird problems when you use the <> in the middle of a post and then try to narrate on. In some posts, it's taken me up to an hour to fix the problem and I inevitably lose whole sections of the narrartive that I have to recreate. To avoid that frustration in the future, code will be at the end.With MA Filter:

Inputs: Len1(1), Len2(6), Len3(10);

Inputs: Len1(1), Len2(6), Len3(10);

If Next3rdFriday(1) = Len1 and Close > Average(Close,Len2)

Then Buy This Bar at Close;

If BarsSinceEntry = Len3

Then ExitLong This Bar at Close;

Without Filter:

Inputs: Len1(1), Len3(10);

If Next3rdFriday(1) = Len1

Inputs: Len1(1), Len3(10);

If Next3rdFriday(1) = Len1

Then Buy This Bar at Close;

If BarsSinceEntry = Len3

Then ExitLong This Bar at Close;

No comments:

Post a Comment