Keeping with my oft voiced analogy of trading and gold mining, you sometimes you find nuggets in unexpected places (and you also find Fool's Gold). Case in point . . today's post.

Keeping with my oft voiced analogy of trading and gold mining, you sometimes you find nuggets in unexpected places (and you also find Fool's Gold). Case in point . . today's post.In my continuing exploration for high correlation Qs pairs I ran the Qs against the major commodity ETFs.

The results, unfortunately, are not encouraging for supplementing my current Qs pairs arsenal.

However, a quick look at the upper matrix will show that the majority of the 90% linearity correlations are linked to a single ETF. . . JJT. Now this looks promising. . . .

If we optimize JJT pairs opportunities in the larger pairs universe there appear to be some very high probability correlated and non-correlated linkages. These various pairs also offer a variety of lookback (N) periods and minimal drawdowns. So far, we're looking good.

If we optimize JJT pairs opportunities in the larger pairs universe there appear to be some very high probability correlated and non-correlated linkages. These various pairs also offer a variety of lookback (N) periods and minimal drawdowns. So far, we're looking good.But before going any further I've got to warn you that more than a few of these ETFs have pathetic volume, wide spreads and little or no open interest in the options.

OK.....now the REALLY bad news. These JJT pairs are utterly untradeable.

JJT's volume is low to none and the bid/ask spreads will take your breath away.

Forget about the JJT pairs for a moment . . . if you could just sell JJT at the ask and buy at the bid (or anything even close) you'd be very rich very quickly and be able to hang out with the glitterati in Monaco.

Likelihood of such a scenario? Sorry . . . Zip.

The lesson to be learned here is that all pairs have to be carefully deconstructed and evaluated with a variety of metrics to provide the greatest probability of real trading success.

Simply relying on high readings of linearity correlation and P&L is not enough.

On the other hand, there do appear to be a few robust trading pair candidates culled from the commodities matrix that offer some reasonable prospects.

We'll check out one of those tomorrow as the Qs basket devlopment continues.

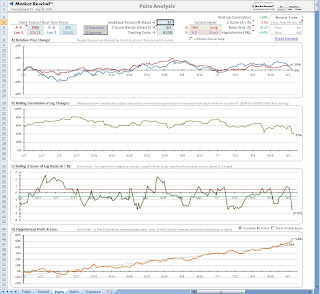

Above is the full profile of the NEW/ERX pair and there are 2 things that I like about this setup.

Above is the full profile of the NEW/ERX pair and there are 2 things that I like about this setup.