This is the latest iteration of the pivots study. Basically' I've recycled the MAMA study using the pivots PP fulcrum in lieu of either high or low values. The results are rather impressive to say the least, with the short side trades being 100% reliable.

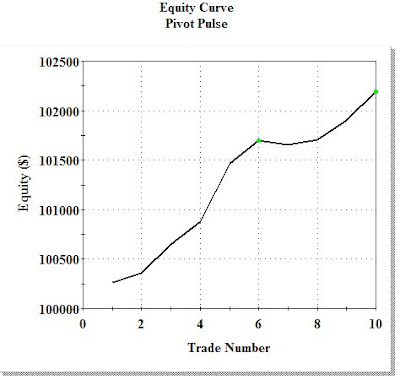

I know, I know, the study only delivers a total of 10 trades over 16 months so I can't expect a Nobel prize in system development for this (otherwise) little gem.

Nevertheless, the goal of these studies is to explore algorithms that yield high probability results, in that respect the pivot pulse delivers. The next logical application of this system is ? (this is a test). . . applying it to smaller time frames such as 60 minute and 10 minute bars to see how (if) the performance results hold up.

And, as I've mentioned previously, there are multiple ways to utilize these systems . . . not only as trading signals, but as trend indicators and signal confirmation for other non-correlated systems.

TS2000i code is shown below. I've created a number of variables to display the code parameters as it makes it somewhat easier to see what's going on. For use on smaller time frames, expect to re-optimize the inputs to reflect increased intraday volatility. If we remove the MarketPosition clauses from the order line "If" statements the system essentially morphs into a stop and reverse format with the fixed bar exits acting as kind of outliers for those longer trending trades. Just something to consider for those that like to deconstruct my coding.

TS2000i code is shown below. I've created a number of variables to display the code parameters as it makes it somewhat easier to see what's going on. For use on smaller time frames, expect to re-optimize the inputs to reflect increased intraday volatility. If we remove the MarketPosition clauses from the order line "If" statements the system essentially morphs into a stop and reverse format with the fixed bar exits acting as kind of outliers for those longer trending trades. Just something to consider for those that like to deconstruct my coding.

No comments:

Post a Comment